By Makutu Manneh

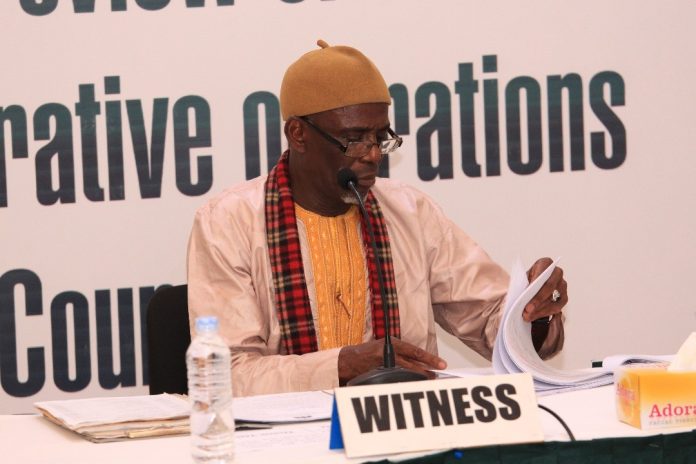

Lead Counsel Patrick Gomez of the Local Government Commission of Inquiry has informed the former CEO, Mam Sait Jallow Of Brikama Area Council that the 2019 National Audit Office indicated in their report that over Forty-Four Million and Twenty Nine Thousand Dalasi (D44,029,000) has been collected by the council using the treasurer’s GTRs, but it could not be accounted for because no evidence was provided to show that the monies were deposited.

Counsel Gomez told him that the NAO reported that Sixty Million, Six hundred and Thirteen Thousand, Seven Hundred and Thirty-Eight Dalasi, Fifty butut (D60,613,738.50) was collected using the treasurer’s GTRs, but the deposit receipts presented to them during their audit amounted to Sixteen Million, Five Hundred and Eighty-Two Thousand, Nine Hundred and Eighty-One Dalasi, Seventy-Four Butut (D16,582,981.74) while over Forty-Four Million and Twenty Nine Thousand Dalasi (D44,029,000) was unaccounted for because the deposit slips are not presented for auditing.

The witness was told that he and the director of finance were responsible for any financial losses since he was the chief accounting officer of the council.

He responded that he does not know whether bank reconciliations were done or not.

“I don’t know. I was not aware,” the witness said.

“It goes to show your administrative inefficiency,” Counsel Gomez said.

The auditors further discovered that the information contained in the cash book and what was contained in the bank were not the same. The witness did not directly answer the question.

The witness was asked why they did not adhere to the provision of the Local Government Act which provides that 40% of the revenue should be used in the council while the 60% should be ploughed back for the development of the area.

The former CEO mentioned that the overhead cost of the Council made it difficult for them to adhere to 40% and 60% requirement as contained in the Local Government Act. He explained that overhead cost includes salaries and other administrative expenses like fuel.

“You think it is normal to spend One Million Dalasi in a month on fuel?” Counsel Gomez asked.

“Yes, it depends on the circumstances,” the witness said.

The witness was asked to provide the 2018 and 2019 financial statements, income and expenditure for the Brikama Area Council on or before his next appearance before the Commission.

The witness was informed about the audit finding that some of the markets have no toilet facilities and the vendors go to the neighbourhoods to use their toilets.

“Correct,” the witness answered.

The witness said he was an ex-officio member of all the committees. He added that the Committees were not active.

“Commitment was lacking from the members,” the witness said.

“You think the councillors did not represent their people very well,” Counsel Gomez asked.

“Yes, they were not very active,” the witness said.

“It is unimaginable that some markets do not have toilets when millions are being collected from the people,” Gomez said.

“Yes,” the witness said.

“There was means to construct the toilets,” Counsel Gomez said.

“Of course,” the witness said.

The witness was questioned about the system of waste collection, which was almost not functional and the people were dissatisfied with the collection system. He admitted and stated that they were facing challenges.

The witness said some Alkalos were encroaching in areas designated as dumpsites and other utilities for the people of the area. He owned up to their weakness by their failure and the Ministry of Lands for not taking up the matter to ensure compliance with the law to ensure it stopped.

He was asked to detail how they recorded the assets of the Council. The witness said at the time they did not have an assets register until the auditors raised it. The management response to the audit finding was that they had an assets register which was not updated at the time. The witness said the assets register was not updated.

The witness said the Establishment Register of the Council was updated on timely basis despite the audit findings that there were incomplete personal files. The witness was referred to the audit report containing the details of the staff whose files were incomplete. The witness confirmed that the audit finding was true.

“These people were there even before I came,” the witness said.

He was told that was not an excuse because he had the responsibility to ensure that the files were up-to-date. He agreed.