By: Kebba AF Touray

Mr. Paul Gaye, an auditor at Neixa Consulting, has urged the UTG to devise safeguard mechanism to reduce its outstanding debts with debtors such as government.

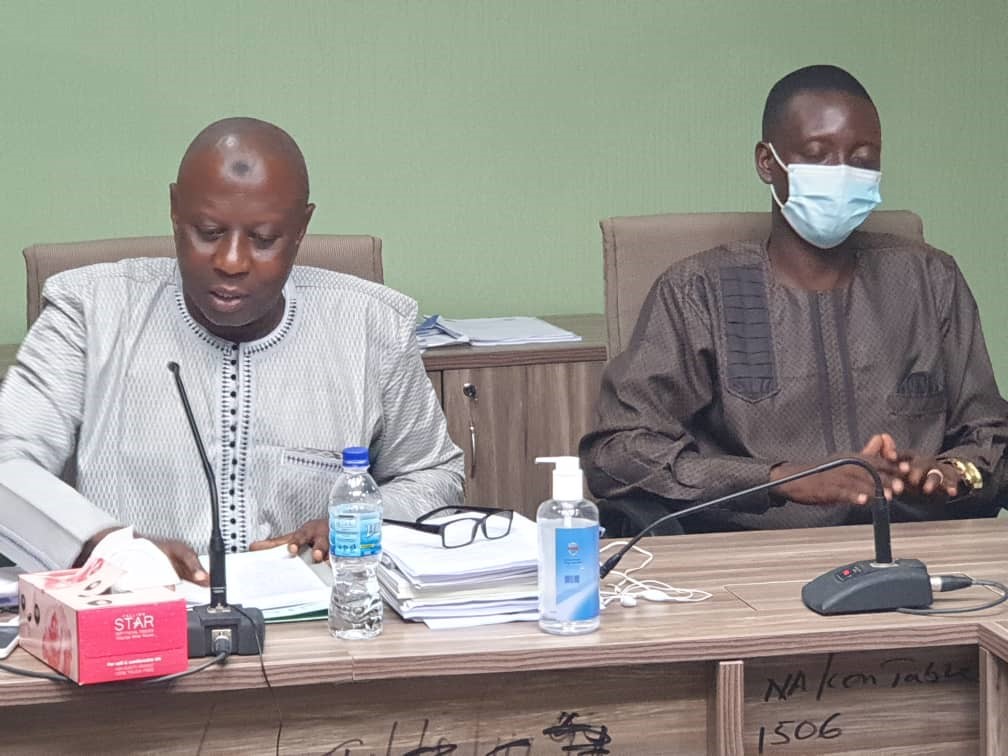

He said this on Wednesday, 4th of November 2020 during a meeting between the UTG and Education Committee of the legislature.

He informed the convergence that they have noticed a trend at the university over the past five years, whereby students’ debts have been mounting yearly and when they looked into the issue, they realized that the debts were rising more than the recoverability, which he said was unrealistic.

He said: “It makes no professional and financial sense to have figures raising your assets with balance sheet going up with mere figures or numbers and records for the books. So we decided to put it to them that they must bring the bad debt figure where it is reasonable that they can recover that amount”.

He said some of the debts were made even before 2014.

According to Gaye, some debtors, especially government, denied owing such debts to the UTG and thus an amount was written-off or set aside, but that does not mean that it will stop them from chasing their debtors, but to avoid inflating unnecessarily their financial statements.

He said: “Notes were simply written on a piece of paper and they are never tracked, from the amount issued, the monthly deductions made and when the staff leaves they would not check whether or not that staff is owing the university”.

He stressed this resulted to some people defaulting in paying the loans over the past few years. He added some significant improvements have been made over the years, but they still believe that there is room for improvement at the university.

He averred: “This is because if there is an effective monitoring mechanism in place, there would not be need to paying on premium to insurance companies to safeguard when staff default”.

He said the UTGB should look into the issue and ensures that a competent accountant is in place to monitoring all the loans and advances to make sure that at any given time, an outstanding balance of the staff is known, as this will save them from paying premium to insurance companies.

He said: “progress is being made but they must safeguard to ensure that in future, there will be no recurrence. It does not make financial sense to have a huge positive balance in an account and be paying interest on overdrafts”.