By Kebba Touray

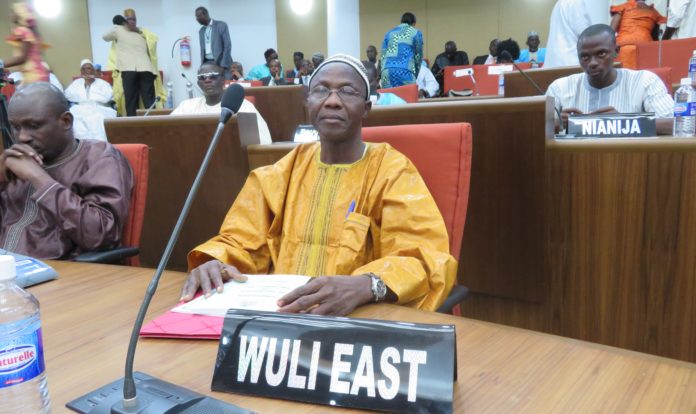

Suwaibou Touray, the National Assembly Member for Wuli East Constituency said he is convinced that the Minister has adequately furnished the House on the economic situation of the country.

He said the Minister has told them clearly that the growth in the economy is slowing down from 6.5% to 4.0%; that Gross Domestic Product (GDP) is also expected to grow by 4.0% instead of 6.5% in 2018, slower than in 2019.

Mr Touray who was speaking during the debate on the budget estimates for the year 2020 at the National Assembly on Thursday 28th November 2019 said:

‘‘We are also told that the Gambia Local Funds (GLF) is not sufficient to cater for the recurrent expenditure needs; That we are in deficit in that regard and therefore we must borrow to be able to meet the deficit.’’

Touray in his contribution referred his colleagues to page 12 of the Minister’s statement and said that they were told there would be fewer revenue and grants in 2020 compared to 2019, which will be almost less by 1 Billion dalasi; that the Minister’s Statement on Page 13, indicate that total expenditure and net lending shall be greater from 28 Billion to 30 Billion dalasi, about 4% of the estimates and that the bulk of that increment is due to debt interest payments; that 40% of Government’s tax revenue in 2020 which amounts to 4 Billion and 648 Million Dalasi, shall be for debt interest payment.

He asked his colleagues to remember that they had paid interest payments amounting to 26% or D2 Billion 702 Million of tax revenues for 2019, which has now increased to 4.648 billion in 2020.

This he said means that despite receiving less revenue for the year, they are still bent on spending more with the intention to borrow more just to be able to spend even more. And this he said is a country that is struggling to come out of the debt trap.

‘‘Hon. Speaker, what then is the solution to this problem?’’ he asked; that according to the Minister, the solution is to borrow more money domestically than they did for 2019; that they need to borrow 3.9 billion dalasi to finance the deficit.

Touray said his understanding is that they are going to progressively reduce domestic borrowing with a view to lowering it to an acceptable level to allow Commercial Banks to have more savings so that they can lend more to local investors in order to boosting the productive base of the economy. He then asked the Minister of Finance to correct him if he is wrong, but the Minister could be seen nodding his head.

Suwaibu then asked whether this is not encouraging a reverse of that trend of thinking; that whatever restructuring they intend to undertake with the country’s debt to free up 2 billion dalasi with a view to defer the payment to a further date, should not be simply to pass the burden of debt to our children to shoulder; but to ensure that the burden of debt repayment be shared between the present and future generation in an equitable way.

He also referred to the Minister’s statement in paragraph 28 and quoted the following:

‘‘For 2019, the projected budget support from the European Union (EU) and the World Bank (WB), which comprises the bulk of our estimated support for this year, have not materialised as at end September’’.

He reminded his colleagues that he had earlier expressed the fear of donor weariness in a situation where a country makes it a culture of depending on donor support; that instead of addressing the crux of the matter, they are choosing the easier way getting more loans to finance ‘‘our deficits’’; that it will be interesting to know what development policy operation targets have not been realised which has given rise to slippages as stated in the Minister’s statement.

On the issue of taxation, Suwaibu said during their oversight functions over NGOs, all the NGOs they visited across the country complained of gross taxation which affects their operations and negatively impacts on their contribution on their target communities; that NGOs play crucial roles in addressing socio-economic needs of rural communities; and that taxing NGOs should be done in such a way that it will not limit their role in addressing the socio-economic needs of rural communities.

Suwaibu also said that he has searched in the Revenue Section of the budget estimates but cannot find anywhere that Gross Taxation is mentioned on NGOs. He called on the Minister to address this anomaly.

On the Legal Aid Agency, Touray explained the important role it plays in the area of human rights as well as in serving as an oversight institution for the Judiciary; that this agency is badly underfunded and personnel do not even have mobility to do their jobs; that they have to move across the country and provide legal aid to needy victims. He said agencies like Ombudsperson, National Human Rights Commission and Legal Aid need adequate funding to carry out their mandate.

On Reparations, the Wuli East Law maker expressed the view that this should be captured in the Budget Estimates for the Gambia to be seen to be serious about reparations; that “we should not establish institutions without helping them to function to serve the purpose for which they are established”; that “the International community will not take us seriously if we do not open a budget on reparations”; that the Minister should ensure this is done.

Coming back to the Budget itself, Suwaibou Touray said one way of helping the country overcome its trade deficit is to ensure that trucks involved in the transportation of goods and services are not obstructed in anyway within or outside our territory; that with their engagement with the GCCI, they were informed that the re-export trade is doing fine but it requires the whole business to be digitalised to ensure that trucks have chips which will make it possible for the authorities to track them and know if there is any interference; “that we should know that we are competing with our neighbours in this area and there should be every effort to maximise our gains”.

In conclusion Suwaibu said: ‘‘I remain convinced that this Budget will be a useful tool in our drive to achieve and sustain macro-economic stability and the Government’s primary objective of reducing poverty and improving basic service delivery for all, if we commit ourselves to strict fiscal discipline’’; that “we should utilise Section 27 of the Public Finance Act to appoint temporarily, a technical staff to assist in identifying pertinent issues such as un-necessary allocations demanded by certain sectors and make recommendations to delete them with a view to reducing the deficit in expenditures”. This he said, will greatly help not only in reducing domestic borrowing but during negotiations with Gambia’s debtors; that he has noticed a lot of anomalies since last year and they tend to ignore them; but that they must now be firm and ready to close all such loopholes to save the scarce funds which are badly needed for productive investment.