By Amie Sanneh

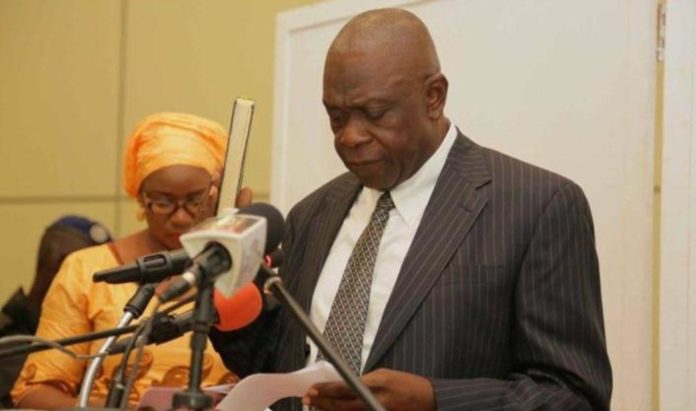

The Minister of Finance and Economic Affairs, Amadou Sanneh, had made amendments to the draft budget estimates for the year 2018, which he earlier presented to the Assembly. Mr. Sanneh officially tabled before the National Assembly the 2018 draft estimates of revenue and expenditure of the Republic of the Gambia for debate and adoption on the 27th November 2017.

Deputies were supposed to debate on the said budget estimates yesterday before it could be adopted but that was not possible as the Finance Minister brought in some adjustments to the draft estimates of the budget. Members therefore requested time for them to go through the amendments and understand it before they can comment on it.

The Finance Minister said they think the amendments they made to the 2018 draft estimates are essential in their drive for fiscal consolidation and the economic road to the budget. This he continued is to strengthen Government’s fiscal and economic policy of 2018.

He explained that the basic tenant of this amendment is that they over estimated a debt repayment on behalf of NAWEC which is the D2.1billion debt which they have factored as 900, 000, 000 for 2018; but that given the fact that they have re-negotiated this debt, instead of the five years, three years has already gone for the repayment; that the D2.1billion scheduled for repayment for the next two years, has been negotiated and agreed upon with banks which was signed and now it will be repaid in seven years. This according to him has reduced the yearly debt service burden on the budget which they want to reflect on; that they have also adjusted some essential line items with the savings on debt service payment and there were other revenue measures which were not fully captured in the budget.

The Finance Minister said government has approved a new vehicle policy in cabinet that only one vehicle will be allocated to the Ministers and permanent secretaries respectively. “This policy means that we will off load a lot of the excess vehicles we have running around and costing a lot for the tax payer in terms of servicing, fuel and new vehicles,” he said. For the junior employees, Minister Sanneh stated that cabinet has approved an additional transport allowance of D1000 for each individual from Grade 1 to 8. This he went on has an impact of about D320 million on the budget.

On severance package for some of the drivers who will be affected if they reduce the number of government vehicles, he said they have put in place D20 million to cater for the package, to give them a new start.

General Service expense in the President’s office used to be D20 million but the Finance Minister said they have added an additional D2 million to cater for certain incidental expenses which was not catered for in the draft estimate budget.

He said the travel vote was reduced significantly in the draft estimates but with the savings available, they have increased it by D18 million from D57 million to D75 million.

Mr. Sanneh said they have now added another D40 million for MDI which has been moved from the President’s office, to the Ministry of Higher Education. This he added will cater for the additional subventions for phase two of the ACE project which is expected to materialize in 2018; that an additional 3.3 million has been given to higher operational cost and another D50, 000 on incidental awards; that Government also allocated D7.6 million to Higher Education for school laboratories and facilities for the TVET project.

On arbitration and court awards, Minister Sanneh said they have increased it from D100 million to D110 million which they want to put aside for awards of damages by the National and ECOWAS courts. He explained that they already have some awards which they have to pay at the ECOWAS court for the late Deyda Hydara and Chief Manneh; that sometimes they have cases against the Government and when Government loses, they have to pay.Thus the need for them to put something in place.

He said the Civil Service Loan Scheme which was estimated at D40 million, has now been increased to D60 million; that this is meant to support the new vehicle policy; that instead of using Government vehicles, it will allow civil servants from the DPS downwards and those who qualify, to apply for their own vehicles.

Mr. Sanneh said they have also increased input subsidies of D75million by another D25 million making it 100 million and that this is meant for fertilizer and seed nuts for farmers; that D50 million has been allocated for specialised technical materials meant for the hospitals, for necessary lifesaving equipment describing the state of the hospitals today as deplorable. According to him, they have already taken measures to provide hospitals with funds this year, to enable them get some of the much-needed equipment to save lives and provide quality services to the citizens.

Under the Global Fund project, he said they have an operating cost under the health service and they put in D10 million as counterpart funds for them to roll in their next program. Mr. Sanneh added that they have other major rehabilitation works and an additional D8 million has been put forward for the medical personnel to build quarters for them especially the department that is renting out; that they want to put another floor at the central medical stores to cater for those departments that are renting outside; that they also put D5million on medical equipment which is counterpart funding for the reverse linkage program that the medical school is implementing with Turkey.

For the Justice Ministry, Mr. Sanneh said an additional D50, 000 has been put forward to cater for fuel on the movement of judges as they move from one court to the other.

‘‘One million is been given to the Fisheries Department to implement the Rural Water Supply and Sanitation Project which is expected to kickoff next year,’’ he stated.

The Finance Minister noted that government’s contribution on the Islamic Microfinance Institute for the Organisation of Islamic Conference (OIC) member countries, has been increased to D26 million as it was D20 million in the draft estimate.

ASYCUDA WORLD software package of D2 Million was budgeted but has now been increased to D13.5 million, making a difference of D11.5million, he said.

On youth development, Minister Sanneh mentioned that an additional D3 million has been added to the D3 million budgeted for National Youth Council and the National Enterprise Development Initiative (NEDI), giving them a total of D6 million each. D3 million has also been added to the National Youth Service Scheme’s (NYSS) budget, giving them a total of D9 million, he said. The President International Award Scheme (PIA) which was budgeted at D4.9 million is also given an addition of D3million making it D7.9million.

For Works, the Finance Minister said D15 million has been added to the D2.4million budget, making D17.4million meant for road feasibility studies.

The National Water and Electricity Company (NAWEC) subsidy has been reduced to D460 million as it used to be D900million, he said.

He said they have catered D15 million for feasibility studies on road infrastructure; that they need to have a feasibility structure in place so that they can source for financing as they have about 3,000 km of road that they need to work on. The gateway proceeds which was under budgeted at D150 million, is estimated to earn the country D640 million. Rice import duty has been reduced from 10% to 0, which is from D1,526 million to D1,383 million, he said.

Excise duty for new imported vehicle has been reduced from 25% to 20% and from 15% to 10% for vehicles that are less than 5 years old. This he said, means revenue will decrease from 338 million to 298 million. According to the Minister, they are trying to avoid the Gambia from being a dumping ground for bad and dilapidated vehicles; that Corporate tax has also been reduced by 3% from 1,126 million to 1,000 million; Personal Income Tax top rate has been reduced by 5% and also increasing the tax free threshold from D18, 000 to D24, 000. This he said will help salary earners to have more take home income on their salaries.

The proposed reduction of Rental income tax for commercial businesses has been reduced from 15% to 10% and residential from 10% to 8%.

The National Assembly Member for Lower Baddibu stressed the need for the sittings to be adjourned since this is dealing with the lives of the people. He said they need to be given time to enable them digest the content of the document.

The Member for Banjul North Ousman Sillah, said what the Assembly needs to do is to follow the constitutional procedure; that the Minister should have waited until they debated on the one that was presented to them first then he comes up with the adjustment; that otherwise, he is pre-empting their interventions; that what they should do is to proceed and debate on the earlier budget estimate presented to them rather than adjourning it.

Voting was conducted on whether to proceed with sittings or to adjourn. Majority of the members voted for sittings to be adjourned till today 6thDecember 2016, before they can proceed with the debate. The speaker Mariam Jack Denton, adjourned the sittings to today.