By Demba Bah

Two top officials of the Banjul City Council – the Chief Executive Officer (CEO) and the Finance Director – on Friday spoke to Foroyaa about their controversies.

On our last week’s Friday edition we published the tussle between the two officials resulting to the involvement of the Gambia Police Force. We detailed the correspondences between the CEO and the Finance Director, where the Finance Director accused the CEO of interfering in his job.

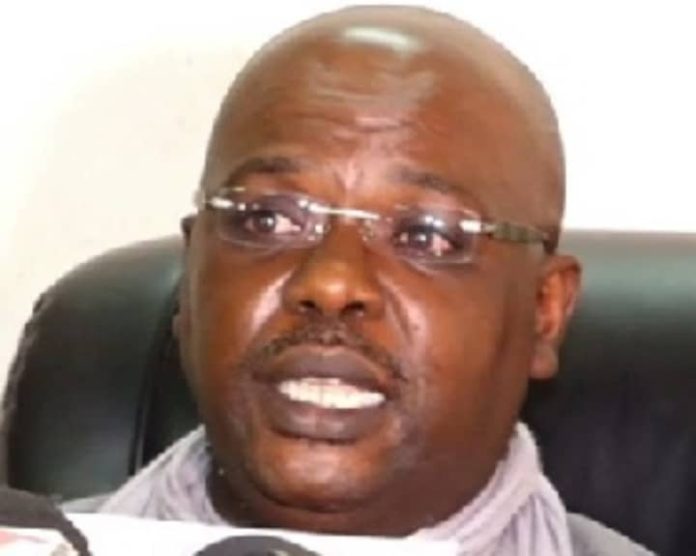

In a face-to-face interview with Foroyaa on Friday, 12 January 2024, the Chief Executive Officer of Banjul City Council, Mustapha Batchilly, gave the genesis of the controversy between him and the Finance Director, Momodou Camara. In the last edition we gave a detailed genesis of the controversy based on the correspondences between the two officials.

Batchilly stated that as the Chief Executive Officer of the city council, he is the sole accounting officer of the council responsible for spending of the revenue of the council. He said he is the signatory to the revenue earning books. He added that he requested for revenue books from the Finance Director, but he chose not to adhere to the instruction. Finance Director Momodou Camara alleged that his signature was being forged and he was taking precautionary measures.

In response to why the matter was taken to the police when the controversy was purely an administrative issue, Mustapha Batchilly said his patience was stretched to the limit. He explained that he tried all avenues to get the Director of Finance to adhere to the instructions, but the Finance Director was not willing to comply. When asked what the instructions were, the CEO said the management of the council decided that in 2024, they will go back to using the “traditional way of doing things”. Asked who the management is and what exactly is the traditional ways of doing things, CEO Batchilly responded that the management comprises directors of planning, finance, internal audit and administration, the CEO, adviser to Mayor, and Commissioner of Security and Council Adviser. As for the traditional ways of doing things, he gave an insight on how the finance department works. Batchilly said revenue collectors are not supposed to report directly to the Finance Director. He described it as a chain or a process comprising frontline revenue heads. He said the frontline revenue heads are the licence manager, rates manager, cost recovery manager and markets manager.

“These frontline revenue heads report to the finance manager who reports to the Finance Director. The Finance Director then supervises the whole process,” CEO Batchilly said.

He was also asked what has the Establishment Committee got to do with the issue, CEO Batchilly responded that the Committee is the recruitment arm of Council and it had recommended for the Finance Director to be sent on a 3-month administrative leave. CEO Batchilly did not elaborate the reasons for the proposed suspension. He only assumed that the strict adherence to the processes might have not gone down well with the Finance Director.

He was further asked why he was insisting on having the revenue books from the Finance Director. CEO Batchilly said he is the Chief Accounting Officer of the Council and he has the power to request for the books from the Finance Director.

Batchilly said Deputy Mayor Abdoul Aziz Gaye, who is also the elected councillor for Box Bar Ward, was given the opportunity to talk to the Finance Director and he eventually handed over the books. Mr Batchilly added that the Council is going through changes and change is not always welcomed.

On his part, Momodou Camara, the Finance Director, revealed that he only handed five (5) trade licences invoice books. He said the serial numbers of the invoice books were 8351-8400, 8401-8450, 8451-8500, 8501-8550 and 8551-8600. He added that he also handed them five Rates and Taxes (Demand Notes) with the following serial numbers: 6751-6800, 6701-6750, 6801-6850, 6851-6950 and 6901-6950 each containing 50 sheets. He informed Foroyaa that the handing over was documented in a memo dated 10 January 2024 sent to the CEO and witness by Deputy Mayor Gaye.

Finance Director Camara said he only agreed to hand over the books when he was assured that the books will be retired, audited, assessed and verified. Asked why he was resolute and adamant in maintaining the revenue books, the Finance Director responded saying “My signature is being forged and there is concrete evidence to that effect.” Finance Director Camara promised to provide the reporter with evidence on an agreed date. The interview was brief and it was schedule for a later date.

Section 405 of the Financial and Accounting Manual on Local Government Authorities 2009 is titled “Control over Receipt and Licence Books”

1) All Receipts, Licence books and forms used in connection with collection of revenue are security documents. The Chief Executive shall arrange for these documents to be printed by the approved printer under strict security conditions and ensures that they are fully accounted for. No other books or forms may be produced, used or impoverised by the employee of the Council.

2) Whenever counterfoil receipts and licence books are required, the Director of Finance through the Chief Executive shall place the order with GPPC or any government approved printer through the DOSLGL&RA. Sufficient notice should be given to the printing corporation to ensure that the documents are available on the required date and before the existing stock is fully exhausted. Only the Director of Finance or any other staff designated by the Chief Executive will be allowed to take delivery of receipts and licence books.

4) The main stocks of unused official Receipts and forms will be under the control of Director of Finance who will take stock of all revenue earning books and receipts on hand at least once in a month, to ensure adequate stocks are available for the following month.

7) The Director of Finance will maintain a Register of Revenue Earning Books in which will be recorded every receipt issued, return and re-issue of these documents. The Register should give the following details:

a) the dates of receipt or issue

b) serial numbers of each book

c) the names and signatures of officers to whom the books are issued

d) the names and signatures of officers making the returns and the dates of return by those officers

e) the name and signature of officer to whom returns are made

f) the maximum and minimum stock levels