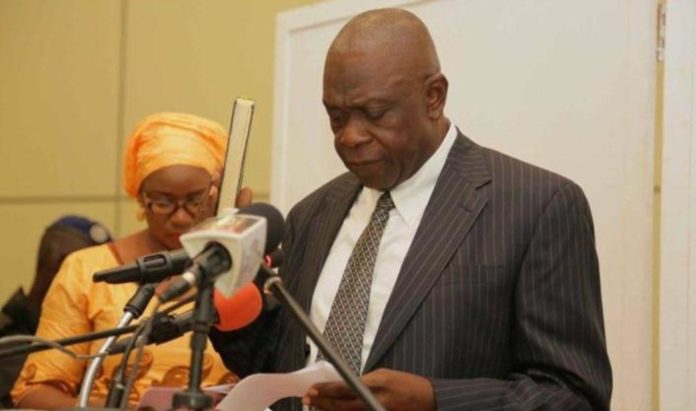

The Minister of Finance and Economic Affairs, Amadou Sanneh, on Friday December 15, 2017, delivered the 2018 budget speech at the National Assembly Building in Banjul, the Gambia.

In the last edition, we did promise the readers that the speech will be serialized in subsequent editions and here the speech goes:-

Honorable Speaker,

I beg to move that the bill entitled “An Act to provide for the services of the Gambia for the period 1st January 2018 to 31st December 2018 (both dates inclusive)” be read a second time.

Introduction

Honorable Speaker,

1. The year 2017 has been a very challenging period for the Gambian economy. With the election of His Excellency, Adama Barrow, as the new President, it marked the turning point of the 22 years of autocratic regime of Former President Yahya Jammeh. It heralded the beginning of our concerted efforts to unwind a legacy of grave economic mismanagement and restore good economic governance, to reverse the stagnation of living standards, symptomized by poverty levels that have been stuck at 48 percent for a decade, and to stem the sharply deteriorating performance of the economy in more recent times.

2. The new Government inherited a debt burden of over D56.5 billion (120 percent of GDP). This huge debt overhang will put immense pressure on Government’s capacity to finance its development agenda for years to come, and at a time when we face pressing development needs and strong expectations for improved livelihoods and lives form Gambians.

3. To mitigate this pressure, the Government is already implementing a series of economic and institutional reforms to foster greater efficiency in the public sector, ensure macroeconomic stability and strengthen the business climate. The reforms will create additional fiscal space to lay the foundation for enhanced private sector participation in economic activities to spur growth and economic prosperity. To complement these reforms, Government has also been adapting its debt management strategy to reduce annual refinancing needs and risks.

4. Government is working closely with our Development partners as we formulate and implement these series of reforms. We note the strong financial support extended by our partners to underpin the reforms already undertaken. Government is currently working with the World Bank to implement the energy sector roadmap, which aims to transform NAWEC into an efficient service delivery institution; its support from the International Monetary Fund (IMF) is centered on putting the country’s macroeconomic fundamentals on a sound footing; and the European Union (EU) is supporting the government in mobilizing the resources necessary for the implementation of the new Development Plan (2018- 2021).

5. The Government’s fiscal consolidation and reforms are already yielding results. The government’s net borrowing requirement has declined sharply from 12 percent of GDP in 2016 to a projected 1 percent of GDP in 2017. We have slowed down the rate of growth in the accumulation of domestic debt. In the wake of this, the cost of government borrowings has also declined markedly with 91-days, 182-day and 364-day Treasury bill yields declining from 17.56 percent, 20.87 percent and 16.97 percent in September 2016 to 5.04 percent, 7.1 percent and 8.11 percent in September 2017, respectively. The challenge is now to sustain this much-reduced crowding out of the private sector and translate it into borrowing, investment growth and jobs by private businesses. The 2018 budget builds on and deepens these reforms to ensure that the results that we achieve are sustainable.

6. Government is committed to striking a right balance between the need to fiscal consolidation on the one hand and, on the other, the imperative to promote much needed public investments and other critical development expenditures to complement reforms and support growth and poverty reduction. The National Development Plan (NDP 2018 – 2021) identifies the highest priority development expenditures to help achieve sustained high growth and improved loves for our citizens. The 2018 Budget will start moving some of the NDP’s key flagship projects and initiatives. Against the backdrop of the debt overhang, we are committed to ensuring that the execution and, in particular, the financing of flagship programs does not further undermine our debt situation. We will work closely with our Development Partner in pursuit of this goal as we mobilize resources for the NDP.

WORLD ECONOMIC OUTLOOK

Honourable Speaker,

7. As per the latest World Economic Outlook (WEO) report (October 2017), The International Monetary Fund (IMF) estimates global growth at 3.6 percent in 2017 compared to 3.2percent last year. This pickup in global activity that started in 2016 gathered steam in the first half of 2017, reflecting firmer domestic demand growth in advanced economics and China and improved performance in other large emerging market economies. The continued recovery in global investment spurred stronger manufacturing activity.

8. In the U.S economic growth is projected to expand at 2.2percent in 2017 and 2.3 percent in 2018. The projection of a continuation of near-term growth that is moderately above potential reflects very supportive financial conditions and strong business and consumer confidence. The downward revision relative to the April WEO forecasts (of 2.3 and 2.5 percent for 2017 and 2018, respectively reflects a major correction is US fiscal policy assumptions. Given the significant policy uncertainly IMF staff’s macroeconomic forecast now used a baseline assumption of unchanged polies, where’s the April 2017 WEO built in a fiscal stimulus from anticipated tax cuts. Over a longer horizon, US growth is expected to moderate. Potential growth is estimated at 1.8 percent, reflecting the assumption of continued sluggish growth in total factor productivity and diminished growth of the workforce due to population aging.

9. The recovery in Euro area is expected to gather strength this year, with growth projected to rise to 2.1 percent in 2017, before moderating to 1.9 percent in 2018 (slightly stronger than the 1.8 percent growth estimated for 2016) The forecast is 0.4 percentage point and 0.3 percentage point higher for 2017 and 2018, respectively, relative to April. The increase in growth in 2017 mostly reflects acceleration in exports in the context of the broader pickup in global trade and continued strength in domestic demand growth supported by accommodative financial conditions amid diminished political risk and policy uncertainty.

10. Growth in the United Kingdom is projected to subside to 1.7 percent in 2017 and 1.5 percent in 2018. The 0.3 percentage point downward revision to the 2017 forecast relative to the April 2017 WEO is driven by weaker-than expected growth outruns for the first two quarters of the year. The slowdown is driven by softer growth in private consumption as the pound’s depreciation weighed on household real income. The medium-term growth outlook is highly uncertain and will depend in part on the new economic relationship with the EU and the extent of the increase in barriers to trade, migration and cross-border financial activity.

11. In Japan, momentum is driven by the strengthening of global demand and policy actions to sustain a supportive fiscal stance, and is expected to continue in 2017, with growth forecast at 1.5 percent. The pace of expansion is expected to weaken thereafter (to 0.7 percent in 2018), based on the assumption that fiscal support fades as currently scheduled, private consumption growth moderates, and the boost from 2020 Olympics-related private investment is offset by higher imports and slower projected growth in foreign demand. Over the medium term, a shrinking Japanese labour force will curtail GDP growth although, in per capita income terms, Japan’s growth is projected to remain close to recent averages.

12. Economic growth in sub-Saharan Africa is projected to reach 2.6 percent in 2017 and 3.4 percent in 2018 (broadly in line with the April forecast), with sizable differences across countries. Downside risks have risen because of idiosyncratic factors in the region’s largest economies and delays in implementing policy adjustments. Beyond the near term, growth is expected to rise gradually, but barely above population growth, as large consolidation needs weigh on public spending. Nigeria is expected to emerge from the 2016 recession caused by low oil prices and the disruption of oil production. Growth in 2017 is projected at 0.8 percent, owing to recovering oil production and ongoing strength in the agricultural sector.