With Abdoulai G. Dibba

PART TWO

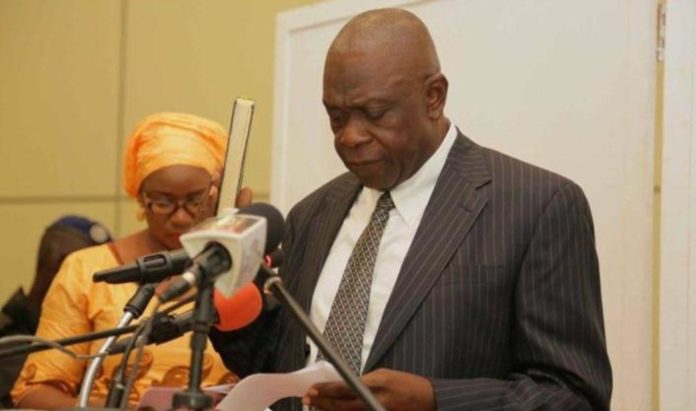

The Minister of Finance and Economic Affairs, Amadou Sanneh, on Friday December 15th 2017, delivered the 2018 budget speech at the National Assembly Building in Banjul, the Gambia.

In the last edition, we started serializing the speech. This is the continuation of the Speech in part two, from where we stopped in the last edition.

RECOVERY IN GLOBAL COMMODITY PRICES

- The IMF’s Primary commodities Price Index declined by 5 percent between February and august 2017-that is, between the reference periods for the April 2017 WEO and the current report.

Some of the biggest price drops were among fuels; oil price fell by 8.1 percent between Februarys an August, even as the Organization of the Petroleum Exporting Countries (OPEC) and some non-OPEC oil exporters announced in May that they would extend oil production cuts through the first quarter of 2018.

The main drivers of lower prices were higher-than-expected US Shale production and stronger-than-expected production recoveries in Libya and Nigeria.

In addition, exports from OPEC countries remained at relatively high levels, even with lower production.

Following some strengthening in recent weeks, oil prices stood at about $50 a barrel as of late August, still lower than in the spring.

- The IMF’s agricultural price index declined by 5 percent between February and August 2017.

Cereal prices rallied in June amid concerns over hot and dry weather in the northern Hemisphere, but then declined substantially in August as forecasts for grain stocks at the end of the 2017-18 season increased unexpectedly.

Meat prices increased on stronger-than-expected demand and tighter supplies.

IMPACT ON THE DOMESTIC ECONOMY

- The impact of global commodity price developments will filter into our domestic economy pass through price for fuel prices.

And as the OPEC cartel continues to reduce production output, this is estimated to trigger increase in the world market price of fuel, rising from US$47.1 per barrel in 2017 to US$53.1 per barrel in 2018; this implies an increase of 12.7 per cent over the review period.

This is expected to have domestic inflationary pressures on fuel prices in the Gambia.

- As the Gambia continues to be a major groundnut producer, international groundnut price forecast indicates a growth in price of 3.1 per cent in 2018 compared to the level in 2017. This will go a long way in improving the income or our local farmers sue to increase price in the international market.

- In addition, as the government has managed to secure the required funding for the 2017/2018 groundnut season, this will enhance foreign currency inflows, thus easing potential pressures on the dalasi, thereby ensuring price stability for imported commodities.

DOMESTIC ECONOMY

REAL SECTOR DEVELOPMENTS

Honourable Speaker,

- The Gambian economy is expected to grow by 3.0 percent in 2017 compared to an actual outturn of 2.2 percent in 2016.

The Agricultural sector, a major force of economic growth is expected to rebound to a 5.5 percent in 2017 compared to 0.5 percent in the preceding year.

Crop-production is also forecasted to grow by 7.6 percent whilst livestock is projected to grow by 3.8 percent compared to -3.4percent and 3.4 percent respectively in 2016. Similarly, Forestry and Fishing is anticipated to expand by 3.0 percent and 5.3 percent respectively against 3.0 percent and 3.5 a year ago.

- Industry is also expected to experience a positive growth of 6.5 percent, contributing to the positive outlook in the economy compared to a contraction of 3.1 percent in 2016.

The Mining and quarrying sub-sector is projected to grow by 5.7 percent compared to a contraction of 10.3 percent in 2016.

In addition, the construction sector is also anticipated to record 11.7 percent growth in 2017 compared to -5.9 percent registered in 2016.

- Service sector growth is anticipated to experience a small set back with growth falling from 5.1percent in 2016 to a forecast of 4.5 percent in 2017.

Hotel and restaurants sector is anticipated to record 5.0 percent in 2017 compared to 19.7 percent in 2016.

The substantially low performance of the sector is due to the negative impact of the December political impasse that affected the tourism sector, leading to low occupancy over the period January-March 2017.

As tourism constitutes the biggest share of the services sector, this invariably led to a contraction in the growth of the sector. Growth in the communication sector in 2017 is expected to register 13.5 percent compared to 9.3 percent in 2016.

While all service sub-sectors are anticipated to experience positive growth, most sectors are projected to register smaller growth in 2017 compared to 2016.

FISCAL SECTOR DEVELOPMENTS

- On the fiscal front, preliminary estimates of government fiscal operations during that first nine months of 2017 indicates an improvement in the fiscal position of government, with revenue and grants expanding to D10.5 billion compared D6.2 billion the same period a year ago, amounting to an increase of 69.4 percent.

Domestic revenue on the other hand, registered a D6.0 billion (14.3 percent of GDO) for the first three quarters of 2017 compared to the same level in three quarter of 2016.

The unchanged level in domestic revenue collection is associate to the impact of the December-January political impasse, which halted economic activities for almost all sectors of the economy.

The impact of the impasse lasted up to the late part of March, as businesses remained cautious in their operations.

- Total expenditure and net lending registered a substantial growth for the first nine months of 2017, expanding from D8.1 billion (18.7 percent of GDP) in 2016 to D18.5 billion (38.4 percent of GDP) in 2017.

Year-on-year, this represents o growth of 128.4percent, it is however important to note that the largest part of the expenditure growth is as a result of increased grants disbursement during the course of 2017.

- Expenditure on personnel emoluments also rose slightly from D1.6 billion (3.7 percent of GDP) for the nine months of 2016 to D1.7 billion (3.5 percent of GDP) the same period in 2017.

Year-one-year, this represents a growth of 6.3 percent over the review period. Interest payments also increased marginally, from D2.4 billion (43.6 percent of tax revenues) in the first nine months in 2016 to D2.5 billion (47.2 percent of tax revenue) in the same period of 2017.

In growth terms, interest payment cost registered a 4.2 percent upshot in nine months of 2017 compared to the same period a year ago.